Alternatives to

Payday Loans

We understand that unexpected expenses are a part of everyday life and that access to credit can be a lifeline during financially challenging times. The OppLoans Platform offers a straightforward alternative to payday loans that can help individuals with bad credit access the funds they need.

Testimonials reflect the individual's opinion and may not be illustrative of all individual experiences with OppLoans.

While payday loans may seem like a convenient path to short-term credit access for those experiencing financial difficulties, it's important to understand the costs and features involved. For example, according to the Consumer Federation of America, a non-profit consumer advocacy group, payday loans range in size from $100 to $1,000, depending on state legal maximums, and carry an average annual percentage rate (APR) of 400%.5 An understanding of how different financial products work is crucial when and exploring alternative options to decide which product may best fit your current financial needs. The OppLoans Platform offers a straightforward alternative to payday loans that can help individuals with bad credit access the funds they need.

Why do people consider payday loans?

Whether it be an urgent car repair or unforeseen life event, relatively small unexpected expenses can be troublesome for many people. In fact, recent studies show that 37% of adults do not have the cash on hand to cover a $400 emergency expense and would be forced to borrow, sell something, or just ignore the emergency altogether. For those with bad credit looking to borrow, payday loans can be an easy way to secure quick cash, as they generally do not require a full credit check, the application can be processed online, and automatic repayment is usually standard. While payday lenders may make the process seem simple, consumers should understand the potential drawbacks in assessing whether or not a payday loan is the best solution for their situation.

Why consider alternatives to payday loans?

Payday loans have received criticism over the years and are sometimes labeled as predatory. In response, certain states have also introduced comprehensive reforms, and certain federal measures have been taken. For example, The National Credit Union Administration has encouraged federal credit unions to offer Payday Alternative Loans (PALs) as an alternative to payday loans. Considering these concerns, it is wise to take a closer look at how payday loans work and explore alternatives to payday loans before making a financial decision.

Payday loans are generally more expensive than installment loans

Payday lenders typically charge fees of $10 to $30 on every $100 borrowed, and while this might sound reasonable, it can translate to an annual percentage rate (APR) of 261% to 782%. Such high APRs are due to the short-term nature of payday loans combined with the calculation of interest rates over an annualized basis. Additionally, payday loan providers may justify the high costs by highlighting convenience and accessibility.

When considering payday loans, you should know that they are not the most affordable form of credit. They are known to have higher rates than installment loans and a higher annual percentage rate (APR) than the average credit card. It is prudent to calculate the full cost of any loan type before making a financial commitment.

Payday loans have a short repayment horizon

A payday loan is usually repaid in a single payment that coincides with your next paycheck, typically over a one—to two-week period. The payday loan contract will provide an exact repayment date, and the contract should be reviewed carefully before signing.

As a first practical step, you should determine if your budget allows you to pay off the loan on time since many borrowers experience difficulty meeting the one to two-week repayment term. In states where comprehensive payday loan reforms have been implemented, it has been shown that borrowers can benefit from more affordable installment loans with extended repayment periods. Make this a key consideration when shopping around.

Payday loan costs increase with rollovers

Depending on individual state laws, borrowers may have the option to defer the repayment of a payday loan if they are unable to make the due date. This process, commonly referred to as a rollover, can be an expensive option since you will be required to pay a rollover fee. It is also worth remembering that a payday loan rollover will not reduce your debt, including any outstanding principal or fees. One of the main concerns with payday rollovers is that consumers are susceptible to repeat borrowing. As a result, borrowers can rack up more in fees than the original principal, while research has shown some payday lenders collect 75% of their fees from those who borrow 10 times or more in a year.

If you are considering a payday loan but want to avoid the risk of revolving debt, make sure to check the payday loan rules in your state to see if lenders are required to offer an extended lending plan. In any case, you should be aware of your options before making any decisions. Your best move might be to look at other alternative options to payday loans.

Ways in which the OppLoans Platform may provide a better alternative than payday loans

If you are experiencing financial difficulties, the OppLoans platform may offer a better alternative to a payday loan and could be a better fit for you. These loans can also be used to pay-off an existing payday loan,5 potentially saving you money. For example, using the OppLoans Platform, you may benefit from the following:

- Lower APR than payday loans: Payday loans can have APRs as high as 400% or more.5 OppLoans provides loans with APRs ranging between 129% and 195%.4

- Longer repayment periods: Payday loans must be paid back by the next payroll cycle to avoid high rates and fees. While the short terms of payday loans may be preferable for some consumers, others may prefer longer, predictable repayment periods. Repayment terms through the OppLoans Platform range from 9-18 months4, which some consumers may find more beneficial for budgeting and repayment.

- No hidden fees: The OppLoans Platform does not charge origination fees, application fees, or prepayment penalties, which may reduce some of the stress of borrowing.

- We look for better loan alternatives for you: Consumers who apply for a loan with our bank partners directly through the OppLoans website can opt-in to our unique and proprietary “Turn-Up” program to find out if you qualify for a loan with participating lenders with an APR below 36%.

- Credit history: OppLoans reports your payment history on behalf of our lending partners to the three major credit bureaus. On-time payments may help boost your credit history.6

In evaluating your options, you should always do your research to carefully understand the costs and benefits associated with any financial products in light of your current situation.

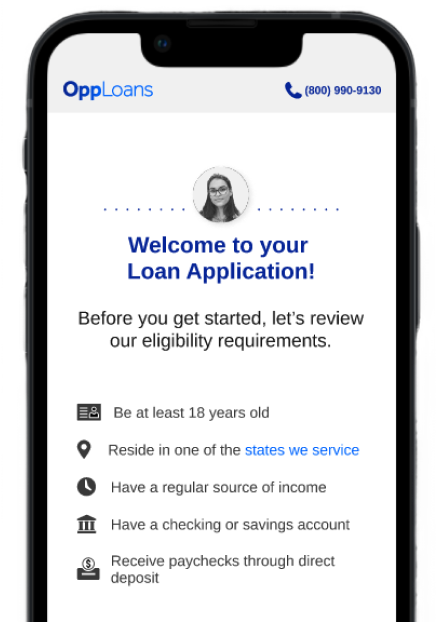

Simple Loan Application Process

Working with community banks, the OppLoans platform offers personal loans designed to fit your needs. The process is simple and built around you:

Apply Online

The application process is quick and easy, with decisions often made in minutes.Approval Process

Our Bank Partners consider more than just your credit score, so even if you’ve been turned down by others, you may still qualify.Same-Day Funding Available

If approved, you may receive money in your account as soon as the same business day!1

Our Loan Application Process

Applying does NOT affect your FICO® credit score.2

Explore other alternatives to payday loans

If you're unsure of your options, here are some other alternatives to payday loans worth considering.

Installment loans

An installment loan is a loan for a set amount of money that is repaid in regular monthly installments over a specific period. Traditional banks and credit unions offer installment loans with reasonable interest rates, provided you meet their credit score criteria. Applicants with bad credit are often ineligible for traditional installment loans.

A recent study concluded that installment loan borrowers in certain states can pay four times less in fees compared to single-payment loans. It also suggests that smaller, more manageable repayments can reduce the likelihood of needing to re-borrow. Additionally, while installment loans typically offer longer repayment terms, borrowers have the option of early repayment, although it's important to check for any prepayment penalties. Borrowers on a tight budget who are looking for longer-term flexibility should consider installment loans a worthy alternative to payday lending.

Credit union payday alternative loans (PALs)

Credit unions sometimes offer “payday alternative loans” (PALs). These are loans of $200 to $1,000 with an annual percentage rate (APR) of up to 28%. Credit unions report to the credit bureaus, so you may use a PAL to improve your credit score. PALs typically have an application fee of up to $20 and can be set up to be repaid in one to three months, which is more reasonable than coming up with the full amount by your next payday. Early repayment is always an option.

PALs are designed to protect consumers from predatory payday lending practices. They are regulated by the National Credit Union Administration (NCUA), which introduced provisions to "curtail a member’s repetitive use and reliance" on payday loans. Similar to installment loans, PALs offer longer repayment terms with strong regulatory oversight, making them a solid alternative to payday loans.

Peer-to-peer (P2P) lending

Peer-to-peer (P2P) lending has become more popular over the past decade because it doesn’t require a bank or credit union. The money comes from individuals or private companies. Its adoption has been accelerated through investment in online intermediary platforms, and the market is expected to continue growing. P2P loans generally require a credit check, which means that fewer borrowers may be eligible for a loan compared to payday loans. However, P2P loans are usually less expensive than payday loans as their costs are typically comparable to traditional lending options. For this reason, it is worth checking the affordability of a P2P loan compared to the cost of a payday loan, and finding out if you are likely to qualify.

Cash advance loans

Cash advance loans are cash advances on your next paycheck. They include credit card cash advances and cash advances from your bank. The former is expensive, and the latter depends on your relationship with the bank where your accounts are held. Cash advance loans may be suitable for people with steady incomes who can afford the fees, but they’re usually not the best option. If you can wait a few days for funds, think about applying for an installment or P2P loan before taking a cash advance.

Nonprofits and charities

If you need immediate funds, you can seek help from nonprofits or charities catering to the needy or impoverished. Economic circumstances are tough, and many people may be in the same situation you are. The most common needs are food, rent, utilities, and clothing. Ask for help if you’re having trouble in any of these areas.

Ask family and friends for help

When you borrow from friends or family, it's usually better than getting a payday loan or other types of loans. That's because the interest rates are usually lower or nonexistent, and the repayment terms can be more flexible. A personal arrangement can help ease worries and steer clear of the fees and interest rates that come with payday loans. Moreover, borrowing from loved ones often may come from an environment where understanding prevails, making it easier to handle and pay back the money borrowed. If you are considering this option, it might help to read up on how to ask for money from friends or family.

FAQs

A payday loan is a short-term loan typically due for repayment on your next payday, up to thirty-one days after the loan is given. The interest and fees on a payday loan are typically much higher than what traditional lenders offer5. The OppLoans Platform does not offer payday loans.

If you can't get a loan, there are several other ways you may be able to get money. For example, you could ask friends or family for help or reach out to charities or nonprofits that help individuals in the same circumstances.

A payday alternative loan is a short-term loan offered by credit unions with an annual percentage rate (APR) of up to 28%. The application fee is up to $20, and repayment terms are typically one to three months. The OppLoans Platform does not offer payday alternative loans (PALs).

No. OppLoans is not a payday lender. Our platform offers online personal installment loans.

The OppLoans Platform offers online personal installment loans, which are unsecured, closed-ended loans that are repaid according to a set term and schedule, where each payment is an equal portion of the total amount borrowed and accrued interest.

For more information, please see our Rates and Terms.