Loans for Bad Credit

We understand a low credit score can make it difficult to get an affordable loan so our Bank Partners do not base funding decisions exclusively on FICO® credit scores. OppLoans' Bank Partners perform a soft credit check when you submit an application.2

Applying does NOT affect your FICO® credit score.2

The figures above are examples of our lending partner’s typical installment loan offers and do not serve as guarantee of any rates & terms that you may qualify for.

Testimonials reflect the individual's opinion and may not be illustrative of all individual experiences with OppLoans.

Why Choose OppLoans for a Loan if You Have Bad Credit?

If you have bad credit, we may be able to help you! Through our commitment to customer service and our lending partners, we help consumers turned away by traditional providers be empowered to improve their financial health. Here are just a few reasons to choose the OppLoans platform for your funding needs:

Simple Loan Application Process

Working with community banks, the OppLoans platform offers personal loans designed to fit your needs. The process is simple and built around you:

-

Apply Online

The application process is quick and easy, with decisions often made in minutes. -

Approval Process

Our Bank Partners consider more than just your credit score, so even if you’ve been turned down by others, you may still qualify. -

Same-Day Funding Available

If approved, you may receive money in your account as soon as the same business day!1

Our Loan Application Process

Applying does NOT affect your FICO® credit score.2

What Is a Bad Credit Loan?

A bad credit loan is for someone whose credit score isn’t high enough to receive a loan from a traditional financial institution. OppLoans does not offer Bad Credit Loans. Instead, the products offered through our platform look beyond your FICO credit score to analyze your overall creditworthiness when it comes to an online personal loan. The credit check we perform on behalf of our lending partners will not appear as a hard credit inquiry on your credit report, so applying won’t negatively impact your FICO score.2

What Is Considered Bad Credit?

In a nutshell, bad credit is when your credit score is too low for you to qualify for a standard loan. A bad credit score is typically considered a FICO score under 670. Your payment history and credit utilization are two of the major factors used to determine your credit score.

Missed payments, maxing out your credit cards, and filling out too many loan applications are unhealthy financial habits that can hurt your credit score and stand in the way of obtaining credit. Unfortunately, lenders view borrowers with low credit scores as less likely to pay back their debts.

But bad credit scores don't have to hold you back. We understand a low credit score can make it difficult to get an affordable loan so we don't base our funding decisions exclusively on FICO® credit scores2 or credit history.

What Makes Up a Bad Credit Score?

There are multiple factors that make up a credit score, including, but not limited to:

- How long you’ve had credit

- The amount you owe

- The amount of your available credit you are using

- The types of credit you have (e.g., credit cards vs. installment loans)

- How much new credit you have

- If you’ve paid your debt on time

What Should Be Considered When Choosing a Loan for Bad Credit?

You don’t have to struggle to find a bad credit loan. Below are a few factors to consider when applying for a loan with bad credit:

- Repayment terms: Your monthly loan repayments should fit nicely into your budget. Affordable repayments can help you successfully pay off your loan.

- Fees and penalties: Prepayment penalties, late fees, and origination fees.

- Annual percentage rate (APR): APR stands for Annual Percentage Rate and is your true cost of credit stated on an annual basis.

- Credit building opportunities: Paying on time should earn you the credit you deserve. Choose a lender who reports repayments to the credit bureaus.

Types of Loans for Bad Credit

Championing your finances means knowing your options. With that in mind, read on to learn about some of the major categories of online loans.

Tribal Loans

Some online loan platforms are owned by sovereign Native American tribes. OppLoans is not a tribal lender.

Offshore Loans

An online loan provider based in another country or offshore is subject to the rules and regulations of the country in which they’re based. This can increase the risk to borrowers in the United States. The OppLoans Lending Platform is proudly based in Chicago, Illinois.

Payday5 Loans

Many payday loan providers have moved online. A payday loan is typically a two week loan, secured by the borrower’s paycheck. Payday loans carry an average interest rate of 400%. These high interest rates and short terms make for an inadvisable combination.

OppLoans is not a payday loan provider. Through the OppLoans Lending Platform, borrowers will get a maximum APR less than half the average payday loan.

Loan Matching

Some online loan platforms are loan matching services. This typically means a borrower can supply some of their financial information and view a list of potential matches to find an online loan provider. Some online loan matching services are reputable, but others are not. OppLoans is not a dedicated Loan Matching Service, but for customers who opt-into our Turn Up Program, we check the market for lower cost loans with approximately 15 near-prime lenders on their behalf, before presenting an offer through OppLoans’ platform.

How To Choose the Best Loan for Bad Credit

Doing your homework before applying for a bad credit loan can make getting a loan hassle-free.

FAQs

When matched with the right lender, a bad credit loan is comparable to a standard online personal loan. OppLoans offers online personal loans designed to give you an affordable monthly repayment. Most of our loans typically have an 18-month repayment term, depending on the state you live in.4 Find out the specific rates and terms in your state here.

Unsecured loans don't require collateral to guarantee a loan offer. OppLoans does not require collateral for loan approval or payment.

OppLoans does not do a hard credit inquiry during the loan application process. When you apply for a loan with us, your credit score is not affected.2

OppLoans is committed to the financial health of its customers. We report your payment history with us to the three major credit bureaus, so every on-time payment you make may help boost your credit history.6

Depending on your state and your income, you may qualify for a loan between $500 and $4,000.4 Your loan amount will be determined by several factors, including your state of residence, income, ability to repay, and creditworthiness.5

For a state-by-state guide, please visit our Rates and Terms page.

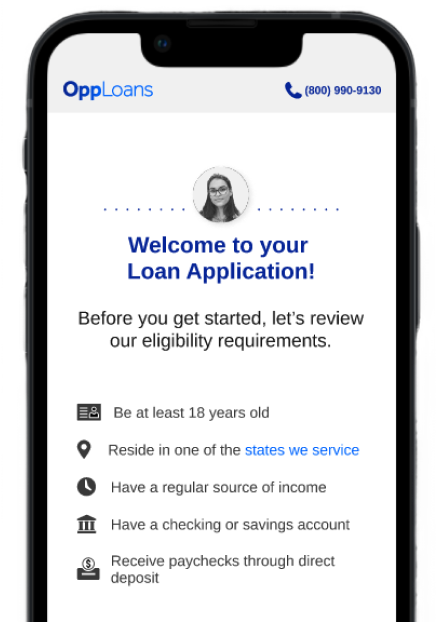

- Be 18 years or older

- Have a bank account (checking or savings account)

- Reside in one of the states in which we currently operate

- Have a regular source of income (Income can be from employment or from benefits including Social Security, Disability, etc. Please note: alimony, child support, or separate maintenance income is optional to include)

- Receive income through direct deposit